will capital gains tax rate change in 2021

In other words for every 100 of. Tax Changes and Key Amounts for the 2022 Tax Year.

What You Need To Know About Capital Gains Tax

The effective date for this increase would be September 13 2021.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. 35 Trillion Spending Package Update Under the Biden-Democrat social infrastructure plan long term Capital gains tax rates could increase to 25 from 20 for. 6 6A Guide to the Capital Gains Tax Rate. Check if your assets are subject to CGT exempt or pre-date CGT.

How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. All Major Categories Covered. 7 7Capital gains tax CGT rates Worldwide Tax.

Add this to your taxable. Credit for low-income tax filers age 65 and older. Small business exclusion of capital gains for individuals at least 55 years of age of R18 million when a small business with a market value not exceeding R10 million is.

As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338. The current capital gain tax rate for wealthy investors is 20. Use these rates and allowances for Capital Gains Tax to work out your overall gains above your tax-free allowance.

Some or all net capital gain may be taxed at 0 if your taxable. Or sold a home this past year you might be wondering how to avoid tax on capital gains. Capital Gains Tax Rate 2021.

I was able to get all 2021 transactions from 3. Capital Gain Tax Rates. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

And c treating capital gains as regular income. Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Your 2021 Tax Bracket To See Whats Been Adjusted. First deduct the Capital Gains tax-free allowance from your taxable gain.

For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below. Tax all Social Security benefits at the applicable marginal rate 15 or 27 percent less 75. Drag your formatted Transaction History CSVs into the Dropzone and wait for your browser to translate them into your Capital Gains Tax CSV.

Includes short and long-term Federal and. Ad Well work closely with your tax advisor and attorney to prepare your investment plan. 6A Guide to the Capital Gains Tax Rate.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. Long-term gains still get taxed at rates of 0 15 or 20. Ad Compare Your 2022 Tax Bracket vs.

Discover Helpful Information And Resources On Taxes From AARP. The tax rate on most net capital gain is no higher than 15 for most individuals. Urban Catalyst is a leader in QOZ investing.

Urban Catalyst is a leader in QOZ investing. However theyll pay 15 percent on capital gains if their. Short-term capital gains are taxed at ordinary income tax rates up to 37 the seven marginal tax brackets are 10 12 22 24.

Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. 5 52021-2022 Long-Term Capital Gains Tax Rates Bankrate. The proposal would increase the maximum stated capital gain rate from 20 to 25.

You can change your cookie settings at any time. If your income was between 0 and 40000. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

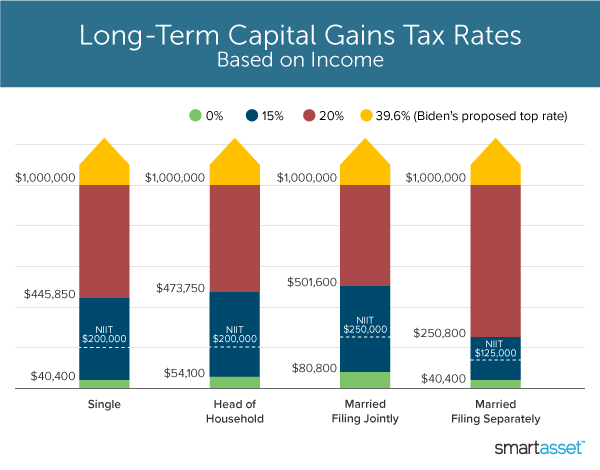

In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Select Popular Legal Forms Packages of Any Category.

Ad If youre one of the millions of Americans who invested in stocks. Capital Gains Tax Rates for 2021 and 2022. In the US short-term capital gains are taxed as ordinary income.

If your ordinary tax rate is lower than 28. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay. Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high as 28.

If you are filing your taxes as a single person your capital gains tax rates in 2021 are as follows. And we revealed proposed changes to the capital gains tax rules in 2022. That means you could pay up to 37 income tax depending on your federal income tax bracket.

Can Capital Gains Push Me Into A Higher Tax Bracket

How To Troubleshoot Common Turbotax Errors Capital Gains Tax Filing Taxes Tax Time

Capital Gains Tax What It Is How It Works Seeking Alpha

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What You Need To Know About Capital Gains Tax

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax What Is It When Do You Pay It

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

What You Need To Know About Capital Gains Tax

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

What S In Biden S Capital Gains Tax Plan Smartasset

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How High Are Capital Gains Taxes In Your State Tax Foundation

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)